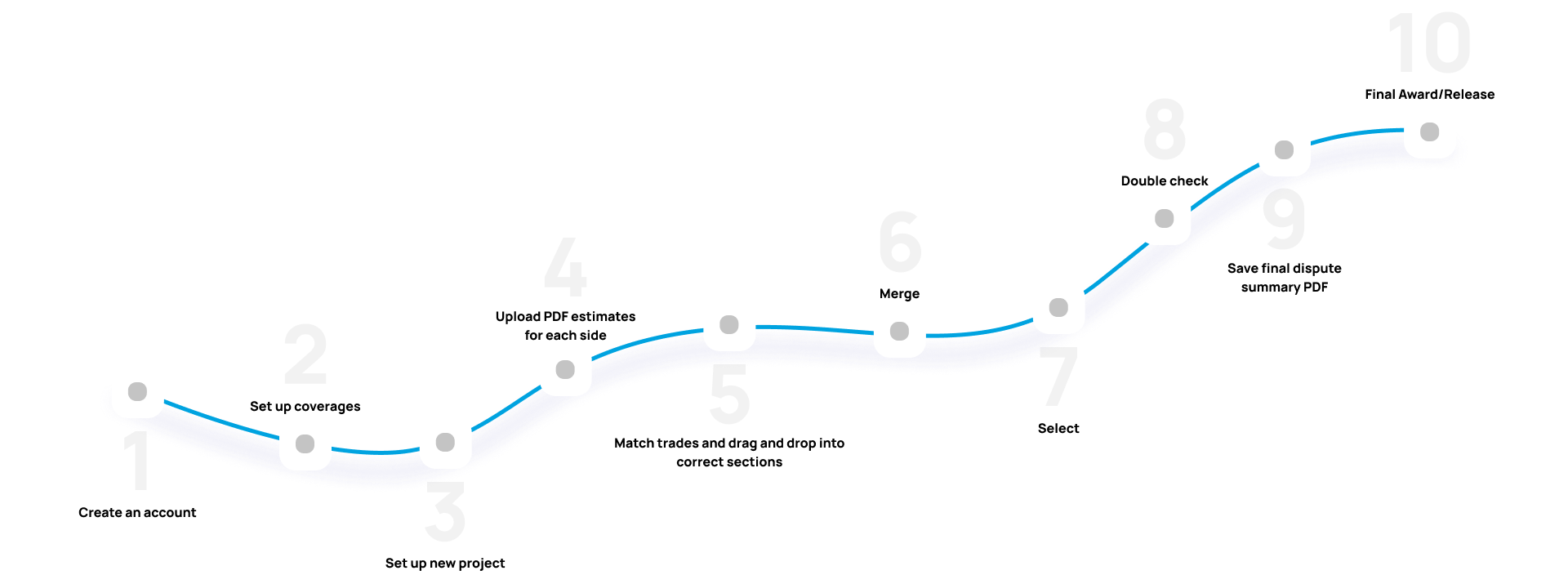

The Umpire Assistant is a web-based application that uses programming, logic, and AI to streamline the appraisal process.

Ready to elevate your experience? Schedule your demo today by reaching out to us atadmin@umpireassistant.orgor give Laura a call at 303-988-2344. Don't forget to have your file ready!

It makes the appraisal process

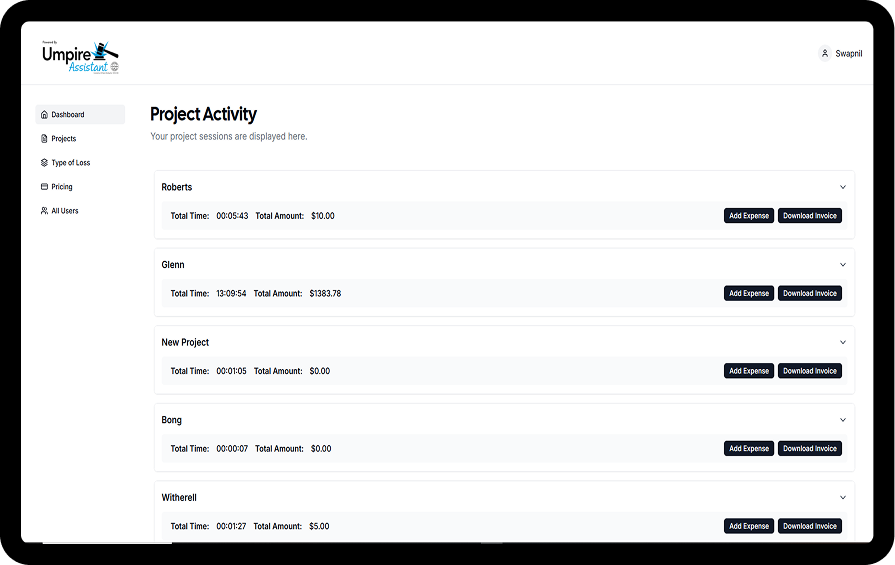

Displays both estimates side by side to easily spot discrepancies.

Aligns items labeled differently in various estimating software.

Lets the umpire select agreed-upon amounts and assign coverage.

Allows modifications before generating the final report.

Logs hours spent for accurate billing.

Here’s what it offers:

It helps

Ensures the umpire only rules on differences, not as a third appraiser.

Speeds up resolution without unnecessary delays.

The final dispute summary is easy to understand for both insureds and insurers.

The award summary can be adjusted to meet state-specific laws.

The dispute summary highlights areas of agreement, promoting faster settlements and higher 3-party awards.

The ADR (Alternative Dispute Resolution) User helps desk examiners, contractors, public adjusters (PAs), and attorneys manage disputed claims quickly and efficiently. Here’s what it offers:

Before they even reach appraisal, It makes the appraisal process

Easily spot differences between estimates.

Aligns line items that may have different names in various estimating programs.

Allows users to agree on amounts and assign coverage.

Make changes before finalizing the report.

Provides a clear record of the resolution.

It helps

Quickly identifies differences and helps resolve disputes efficiently.

Ensures both insureds and insurers understand the final decision.

The final award summary can be adjusted to meet state-specific laws.

Streamlining Your Appraisal Process for Greater Transparency

Appraisal is a policy provision located in the Loss Settlement section, serving as an alternative dispute resolution method. It helps resolve disagreements between the insurer and policyholder regarding the amount of loss, offering an alternative to litigation. However, appraisal does not address coverage issues and may include or exclude items based on causation, depending on state laws.

Each appraiser sets the amount of loss as they see fit. If the appraisers disagree on the amount of the loss, the umpire will try to get the parties to resolve all or a portion of their differences so the dispute is either resolved completely or the differences are narrowed down. The umpire will then rule on the differences. In order for a decision to be enforceable, it must be agreed to by at least two of the three persons, including the appraisers and umpire.

Investing in real estate can be rewarding, but it requires careful planning. Look into financing options, property management, and local market conditions to make informed decisions that align with your financial goals.

Once the umpire is invoked, it could be that, the appraisers worked for a couple months trying to resolve or even a year. Does an umpire in an insurance appraisal have a deadline to get work completed and move the matter along to an award?.The unfortunate answer is “no.” Unless the policy sets timelines, there are no deadlines for how long appraisers or umpires have to complete their duties.The app can not only assist with timely resolution, it also complies with the policy to only RULE ON THE DIFFERENCES.

Still have questions? Reach us any time